The Fiscal Burden of Illegal Immigration on California Taxpayers

By Matthew O’Brien, Director of Research and Spencer Raley, Research Associate

Click here full PDF version of this report

Introduction

Californians bear an enormous fiscal burden resulting from playing host to a massive illegal alien population estimated to consist of almost 3 million foreign nationals. The annual expenditure of state and local tax dollars on services for that population and their children is $23 billion. That total amounts to a yearly burden of about $1,800 for each legally present California household.

According to the California Policy Center, the Golden State’s total state/county/municipal debt tops a staggering $1.3 trillion.[1] Meanwhile, as the state teeters on the brink of economic collapse, its civic and political leaders relentlessly advance laws and policies that attract and reward illegal immigration. And, all the while, they ignore the simple fact that cooperating with the federal government in its efforts to suppress illegal immigration would decrease the massive cost imposed on taxpaying citizens and legal immigrants living in California.

Methodology

This report is an offshoot of FAIR’s nationwide study The Fiscal Burden of Illegal Immigration on United States Taxpayers. Accordingly, with minor exceptions, the methodology used to compile this report is the same as that employed to prepare the larger document from which this one is derived. Unless otherwise noted, whenever a “FAIR estimate” is cited for a particular figure, it is drawn from the 2017 edition of The Fiscal Burden of Illegal Immigration on United States Taxpayers.[2]

Some state and local estimates are based on pro rata national shares, for example: some medical and other welfare rates. The cost of these programs are created at the state level, but the federal government helps pay for a percentage of them. In this study, we only calculate the state share of the costs.

More information on our methodology for state and local costs can be found in our National Fiscal Cost Study.

California’s Stormy Relationship With Immigration Law

Although it is currently hard to believe, California was once a national leader in advocating state legislation aimed at curbing the costs associated with illegal immigration. In November of 1994, Golden State voters approved Proposition 187, a bill aimed at prohibiting illegal aliens from accessing the majority of state-funded social services.

Illegal alien advocacy organizations promptly sued. And in a shocking display of judicial activism, Proposition 187 was immediately enjoined by the federal courts. It was subsequently overturned, in a poorly-reasoned decision, as an intrusion into the federal government’s exclusive authority to regulate immigration. Because California’s Attorney General never appealed the decision, it still stands.

Nevertheless, the successful passage of the bill – by a whopping 17 percentage point margin – demonstrated average Californians’ concern over the soaring costs associated with providing social services to the state’s massive population of illegal aliens.

In the intervening two decades, the state has shifted in a decidedly more progressive direction. It currently seems bent on defying every federal restriction applicable to illegal aliens. Of course, a state cannot overturn a federal law. But that hasn’t stopped California from deliberately interfering with the federal government’s attempts to secure our borders and restore the rule-of-law to our immigration system. And California’s state and local governments have been actively aided and abetted by the federal courts in the radically left-of-center 9th Judicial Circuit.

The state has a recent history of encouraging illegal aliens to seek refuge its communities and attempting to shield immigration violators from deportation, even those with criminal convictions. Listed below are just a few of the atrocious measures passed by the California legislature in a deliberate attempt to nullify the Immigration and Nationality Act:

- Effective January 2018, Senate Bill 54 effectively bars California law enforcement agencies from any meaningful cooperating with federal immigration officers. In particular the law:

- Prohibits California officials from retaining a jailed immigration violator for transfer to U.S. Immigration and Customs Enforcement (ICE), unless the individual has been convicted of a serious felony or ICE possesses a criminal arrest warrant issued by a federal court.

- Prevents police and correctional officers from transferring an illegal alien into ICE custody unless the alien is a sex offender or they have committed a significant crime in the past 15 years.

- Bars California state officials from sharing any information with the federal government about an alien that is not available to the general public.[3]

- 2011: California passed the “Employment Acceleration Act of 2011,” which banned state agencies and localities from requiring private employers to use E-Verify.[4]

- 2011: California passed their own version of the “DREAM Act,” which allows illegal aliens brought into the nation under the age of 16 to receive financial aid so long as they meet certain educational requirements.[5]

How times have changed! Prop 187, prophetically known as the “Save our State Initiative,” would have saved California hundreds of millions of dollars.[6] By contrast, the recent attempts to provide people who have no right to be in the United States with an extensive package of taxpayer-funded benefits promise to saddle numerous generations of Californians with trillions of dollars of debt. This is driving lawfully present immigrants and U.S. citizens out of the state, in search of fiscal sanity. In fact, so many people are leaving California, U-Haul franchises in the state are running out of moving trucks.[7]

To make matters worse, since 1994, the Golden State’s illegal population has exploded, while its economy has deteriorated. The total illegal alien population has increased by roughly 26 percent, while jobs have disappeared, and illegal aliens have been given expanded access to even more publicly-funded benefits and services.[8].

Overall Illegal Alien Population: 2,646,100

By a wide margin, California has the highest number of illegal aliens of any state, accounting for over 21 percent of the entire illegal alien population in the United States. According to FAIR’s estimate, California hosts approximately 2,646,000 illegal aliens.[9] This is approximately 43 percent more than Texas, the state with the next highest total.

Why do so many illegal aliens flock to California? In short, it’s because the state not only protects illegal aliens from immigration enforcement, it consistently rewards those who break our immigration laws. [10] The result is that illegal aliens flock to the state, costing taxpayers billions of dollars every year.

In addition to those who are illegally present in California, there are also approximately 889,000 U.S.-born children of illegal aliens residing in the state. Were it not for their parents’ violation of our immigration laws, these children would not reside in California.

Approximately 197,000 of the state’s illegal aliens are recipients of Deferred Action for Childhood Arrival (DACA), and another 384,000 meet the qualifications to apply for the program, should Congress decide to write it into law and invite additional applications.[11] This is up from approximately 165,000 in 2013.

It is a myth that most DACA applicants are vulnerable children. In fact, 56 percent of all applicants in California were over 20 years old when first applying.[12] Should Congress provide DACA recipients with a path to citizenship, they are likely to serve as a magnet attracting to the Golden State thousands of additional illegal aliens in search of an amnesty.

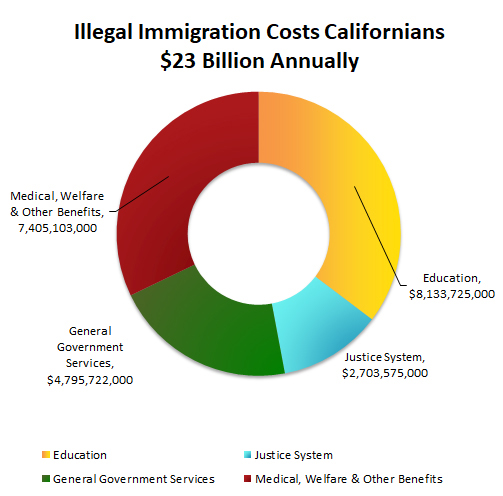

Overall Fiscal Burden to Taxpayers: $23,038,125,000[SR1]

According to FAIR’s 2017 edition of The Fiscal Burden of Illegal Immigration on United States Taxpayers, Californians are on the hook for over $23 billion that is directly attributable to illegal immigration and its effects. This amounts to a staggering $1,799 paid per legally present household every year. Each member of a household headed by an illegal alien costs California taxpayers $6,517 per year.

California taxpayers pay for a wide variety of services offered to illegal aliens, including education, healthcare, public assistance, general government services, etc.

In addition to these benefits, California offers state-specific benefits such as CalWorks, a state welfare program that gives cash aid and services to Californians with an income and total resources below certain thresholds that are based on family demographics.[13]

Students from Illegal Alien Households: $8,133,725,000

About 760,000 students in California come from illegal alien households, which amounts to 21 percent of the illegal alien children currently enrolled in American schools. These include both students who are illegally present in the states themselves and the U.S.-born children of an illegal alien parent.

California’s K-12 budget is approximately $77 billion.[14] Of this total, approximately $8.1 billion are state funds allocated to educating students from households headed by an illegal alien.[15]

A significant portion of this massive education budget is spent on services for Limited English Proficiency (LEP) students. In a 2016 report, FAIR estimated that California needs approximately 17,000 new Limited English Proficient (LEP) qualified teachers to keep pace with the increasing number of students whose primary language is not English. In California, illegal aliens make up the majority of LEP students. These additional teachers would cost approximately $1.2 billion.

The California Dream Act (CDA) allows illegal aliens enrolled in college to apply for state-funded student aid. As of 2018, nearly 25,700 of the illegal aliens in the state applied for CDA financial assistance. Of these, nearly 9,500 applicants were approved, and just over 5,000 accepted money from the program.[16]

The state offers up to $12,630 for an illegal alien attending a University of California institution, up to $9,084 for an illegal alien attending a private non-profit college, up to $5,742 for an illegal alien matriculating at a California State University institution, and up to $1,672 for an illegal alien attending a California Community College. Based on these numbers, the total cost to Californians could be up to $63,150,000.[17]

Impact on the Justice System: $2,703,575,000

Illegal immigration impacts the justice system in many ways. Immigration enforcement is a federal responsibility — at least, that is the argument of those who oppose state and local efforts to cooperate with the Department of Homeland Security. But the truth is that state and local governments face extensive criminal justice expenditures related to the presence of illegal aliens. These costs derive from all aspects of the criminal justice process – from neighborhood policing activities, to criminal investigations costs, prosecutors’ salaries, the costs for court-appointed defense counsel and pre- and post-trial incarceration costs.

Because California has such a massive illegal alien population, FAIR estimates that it spends approximately $2.7 billion annually on justice costs related to illegal immigration.

The federal government reimburses states for the costs associated with incarcerating illegal aliens through the State Criminal Alien Assistance Program (SCAAP). Unfortunately, SCAAP grants fall far short of covering the actual detention costs actually incurred by California. In 2016, the state received just under $67.5 million from the program. That amounts to about 2.5 percent of the total cost to taxpayers.[18]

SCAAP also provides a snapshot of how many illegal aliens are incarcerated in state and local prisons. However, it is inevitably a low estimate because not all state and local correctional entities submit a reimbursement claim for every detained alien. (For example, many counties in California refuse to submit any reimbursement claims, because they will not cooperate in any way with federal immigration enforcement efforts.)

Data from the SCAAP program indicates that there are at least 42,812 illegal aliens in California’s state prisons and county jails. Based on the total number of illegal aliens in the state, it appears that at least 1.62 percent of illegal aliens in California are incarcerated in a state facility. These estimates do not include illegal aliens currently detained in federal facilities located in the state.

According to information provided by the Prison Policy Initiative, there are approximately 178,000 individuals who are not illegal aliens currently incarcerated in California state prisons.[19] (This group includes native-born U.S. citizens, naturalized citizens and aliens who were lawfully in the United States when they committed a crime.) Based on Census Bureau data, that accounts for approximately 0.48 percent of the total non-illegal alien population in the state, meaning that illegal aliens in California are incarcerated at a rate at least 3.6 times higher than a legally present resident or U.S. citizen. [20]

Unfortunately, the growing number of “sanctuary cities” in California are likely to cause criminal justice costs in the state to increase dramatically over time.

General Government Services: $4,795,722,000

Illegal aliens use a number of services that must be provided to them, even though their tax contributions only cover a small portion of the costs involved. Examples of general expenditures like these are the costs of general governance, garbage collection, fire departments, street cleaning and maintenance, etc.

These services are typically funded jointly from state, county and municipal funds. For the bulk of these services, FAIR estimates that the costs are generally shared, with the state government absorbing roughly 65 percent and county and/or municipal governments shouldering 35 percent. Based on the cost of living in California, we estimate that these services cost taxpayers approximately $4.8 billion.

Medical, Welfare and Other Benefits: 7,405,103,000

California’s illegal aliens are provided with a number of medical, social welfare, and other related programs at taxpayer expense. FAIR estimates that these costs amount to approximately $7.4 billion, annually. The rate at which illegal aliens use these programs in the Golden State is significantly higher than it is in other states, simply because California doesn’t care, nor ask about, immigration status. These costs will grow exponentially as the illegal alien population in California both increases and ages.

Tax Receipts: $970,010,000

Illegal aliens pay very little in state and local taxes. In fact, FAIR’s national cost study found that the average illegal alien only pays about $285 in state taxes each year. This number fluctuates greatly from state to state because their income tax rates and tax brackets vary significantly. It is also an average, so individual tax payments may be both higher and much lower, depending on income and taxable assets. Millions of illegal aliens live in states like Texas or Florida, which have no income tax at all. Some also pay no income taxes and recover a net profit in the form of refundable tax credits.

However, because California imposes numerous taxes not levied by other states, and because over 20 percent of the nation’s illegal alien population lives there, we estimate that California’s illegal alien population accounts for approximately 28 percent of the $3.5 billion in state and local taxes paid by illegal aliens nationwide. This amounts to just under $1 billion.

Income Tax

In California, the income tax rate at the lower earning tiers is effectively 2-3 percent. When adjusted from the national average for the higher wages typically paid in the state, FAIR estimates that the average illegal alien household earns approximately $44,300 in California. This means each household will likely pay about 2 percent of that total to state income tax, or roughly $886, once standard deductions are factored in.[21]

As noted in our Fiscal Cost Study, there are about 4,000,000 illegal alien households in the United States. Approximately 840,000 of them live in California. Once those who are unemployed or working in the underground labor market are factored, that leaves about 335,000 households that are likely to pay some state income tax. This totals approximately $296,810,000.

Property Tax

The average price of a home in California is incredibly high, so we estimate that the rate of home ownership by illegal aliens is lower than in other parts of the country. To own an average-priced home in California, a household would need to earn about $78,000, according to the Sacramento Bee and Trulia.[22] That’s an income about 43 percent higher than that earned by the average household headed by an illegal alien. However, there are some counties where the average home price falls closer to $270,000. In those areas, we estimate that illegal aliens who are earning considerably more than average would reasonably be capable of affording a home. Therefore, based on the total number of illegal alien households and their mean income, we estimate that about 100,000 illegal alien households own a home in the state.

State-wide property tax rates in California are statutorily fixed at 1 percent pursuant to the terms of Proposition 13.[23] When local rates are added, the average overall rate comes close to 1.25 percent. This means the average illegal alien household would pay approximately $3,375, which (for 100,000 illegal alien households) makes the overall total approximately $337,500,000.

Other Taxes

There are many other taxes that illegal aliens pay in the state, from sales tax, to fuel, to transportation and other excise taxes. It would be difficult to tabulate all of these together with perfect accuracy, but based on the overall state rate, along with the average tax rates levied by municipalities on these goods and services, we estimate that illegal aliens pay an average of $1,002 per household every year for all other taxes. This number is slightly lower than one would expect based on the average income of illegal alien households. This is because FAIR estimates that illegal aliens remit approximately 20 percent of their incomes to their home countries. Remittances are a net loss to the state as it is money not circulated in the local economy, and therefore not subjected to any taxes.

Based on these numbers, we estimate that illegal aliens pay approximately $335,700,000 every year in taxes not related to their income and property.

Conclusion

It costs California taxpayers approximately $22,068,000,000 each year to provide services to their state’s illegal alien population. And the taxes paid by illegal alien households in California only cover about 4[SR2] percent of those costs. The fiscal burden associated with massive illegal immigration is already enormous, and it will continue to increase as long as the illegal alien population in the state keeps growing, and as long as the state continues to extend taxpayer-funded services to illegal aliens.

The costs related to the presence of illegal aliens in the Golden State can be lowered. The most effective step a state can take to discourage the arrival of illegal aliens is to utilize the E-Verify screening system designed to prevent employers from hiring illegal workers. However, California seems to be moving in the opposite direction by adopting measures designed to accommodate the presence of illegal aliens.

In the end California’s irresponsible illegal alien policies may lead the state to bankruptcy. It cannot continue to fund generous benefits packages while simultaneously increasing the state’s population of those individuals who pay the lowest taxes and consume the most services – illegal aliens.

[1] Bill Fletcher and Marc Joffe, “California’s Total State and Local Debt Totals $1.3 Trillion,” California Policy Center, January, 2017, https://californiapolicycenter.org/californias-total-state-local-debt-totals-1-3-trillion/.

[2] Matt O’Brien and Spencer Raley, “The Fiscal Burden of Illegal Immigration on United States Taxpayers,” Federation for American Immigration Reform, 2017, /issue/publications-resources/fiscal-burden-illegal-immigration-united-states-taxpayers.

[3] FindLaw, “California State Immigration Laws,” Accessed May 2018, https://immigration.findlaw.com/immigration-laws-and-resources/california-state-immigration-laws.html.

[4] Employers Choice Screening, “Employment Acceleration Act,” Accessed May 2018, https://employerschoicescreening.com/news/legal-alerts/employment-acceleration-act/.

[5] California Student Aid Commission, “CALIFORNIA DREAM ACT Apply by March 2,” May, 2018, https://dream.csac.ca.gov/.

[6] Ballotpedia, “California Proposition 187, Illegal Aliens Ineligible for Public Benefits (1994),” May, 2018, https://ballotpedia.org/California_Proposition_187,_Illegal_Aliens_Ineligible_for_Public_Benefits_(1994).

[7] Michelle Robertson, “So Many People are Leaving the Bay Area, a U-Haul Shortage is Jacking Up Prices,” SF Gate, February, 2018, https://www.sfgate.com/expensive-san-francisco/article/U-Haul-San-Francisco-Bay-Area-prices-shortage-12617855.php

[8] Department of Homeland Security, “Illegal Alien Resident Population,” Accessed May 2018, https://www.dhs.gov/xlibrary/assets/statistics/illegal.pdf.

[9] FAIR’s illegal alien population estimation is derived from our 2017 factsheet “How Many Illegal Aliens are in the U.S.” /issue/illegal-immigration/how-many-illegal-immigrants-are-in-us.

[10] Melanie Mason, “California gives immigrants here illegally unprecedented rights, benefits, protections,” Los Angeles Times, August, 2015, http://www.latimes.com/local/california/la-me-california-immigrant-rights-20150811-story.html.

[11] Migration Policy Institute, “Deferred Action for Childhood Arrivals (DACA) Data Tools,” Accessed May 2018, https://www.migrationpolicy.org/programs/data-hub/deferred-action-childhood-arrivals-daca-profiles.

[12] U.S. Citizenship and Immigration Services, “Characteristics of Individuals Requesting and Approved for Deferred Action for Childhood Arrivals (DACA),” Accessed May 2018, https://www.uscis.gov/sites/default/files/USCIS/Humanitarian/Deferred%20Action%20for%20Childhood%20Arrivals/USCIS-DACA-Characteristics-Data-2014-7-10.pdf.

[13] Disability Benefits 101, “CalWORKs: The Details,” May, 2018, https://ca.db101.org/ca/programs/income_support/calworks/program2.htm.

[14] California Department of Education, “Education Budget,” Accessed May 2018, https://www.cde.ca.gov/fg/fr/eb/.

[15] FAIR’s calculations of education costs for illegal aliens is based in data extrapolated from both the “Fiscal Burden of Illegal Immigration on U.S. Taxpayers, 2017,” and “The Elephant in the Classroom: Mass Immigration’s Impact on Public Education,” /issue/publications-resources/fiscal-burden-illegal-immigration-united-states-taxpayers, /issue/publications-resources/elephant-classroom-mass-immigrations-impact-public-education.

[16] Larry Gordon, “Applications for California grants to undocumented college students lag as officials encourage more,” EdSource, February, 2018, https://edsource.org/2018/applications-for-california-grants-to-undocumented-college-students-lag-as-officials-encourage-more/594171.

[17] Ibid, NOTE: California operates at least three separate higher education systems, the University of California System, the California State University System, and the California Community Colleges System.

[18] U.S. Department of Justice: Bureau of Justice Assistance, “STATE CRIMINAL ALIEN ASSISTANCE PROGRAM (SCAAP),” https://www.bja.gov/ProgramDetails.aspx?Program_ID=86#horizontalTab8.

[19] Prison Policy Initiative, “California profile,” Accessed May 2018, https://www.prisonpolicy.org/profiles/CA.html.

[20] U.S. Census Bureau, “QuickFacts,” Accessed May 2018, https://www.census.gov/quickfacts/CA.

[21] Tax-Brackets.org, “Tax Year 2017 California Income Tax Brackets,” TY 2017-2018, https://www.tax-brackets.org/californiataxtable.

[22] Phillip Reese, “See how much income you’d need to afford a home in most California cities,” The Sacramento Bee, Accessed May 2018, http://www.sacbee.com/site-services/databases/article13255952.html.

[23] California Tax Data, “What is Proposition 13?” Accessed May 2018, https://www.californiataxdata.com/pdf/Prop13.pdf.

[SR1]Possible Graphic: “California makes up 21 percent of the illegal alien population in the nation, and 26 percent of the overall national cost to state taxpayers.”